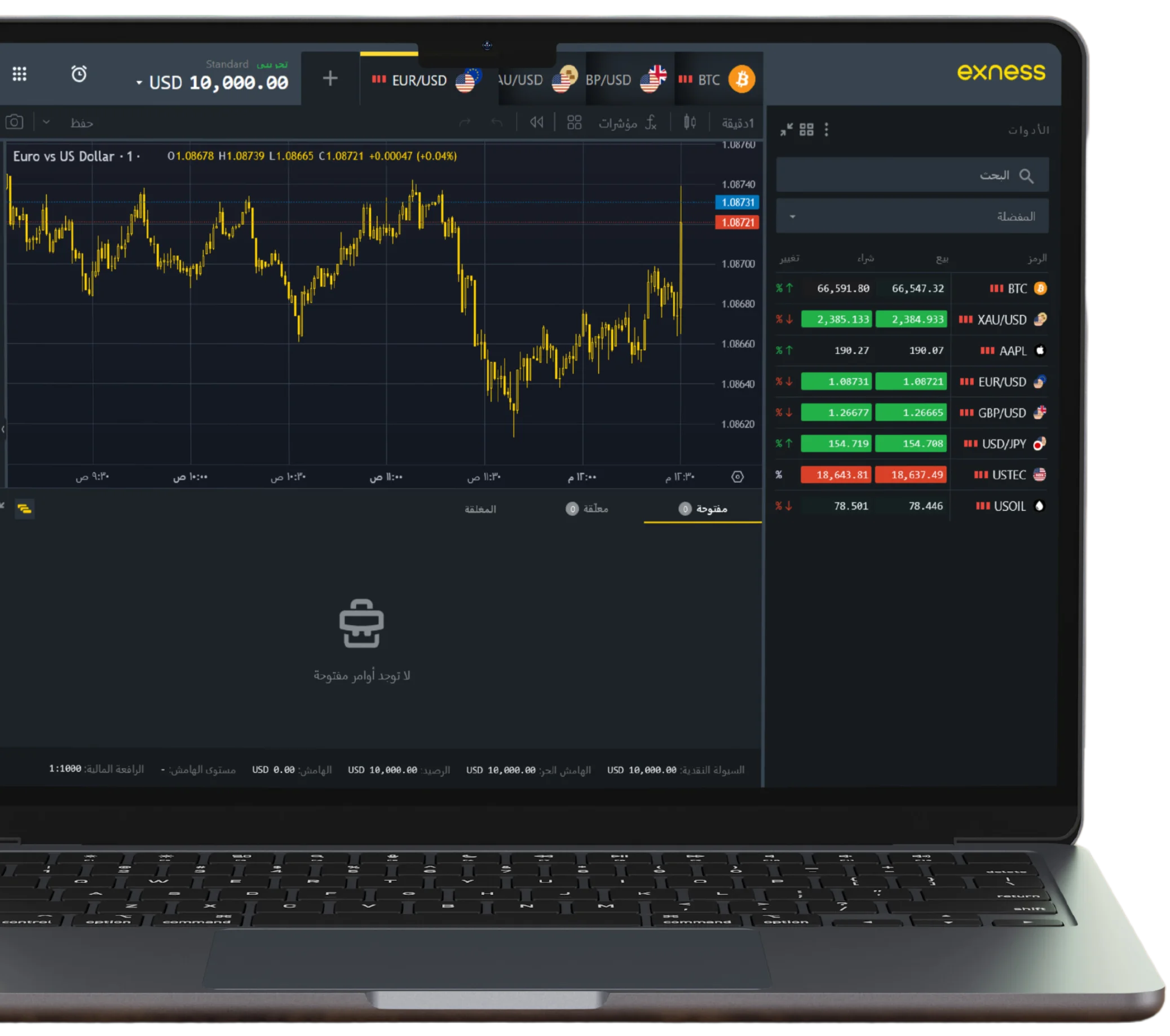

Best trading experience

Exness provides traders with access to popular platforms like MetaTrader 4 and MetaTrader 5, ensuring a familiar and reliable trading environment. With features like automated trading and technical analysis tools, it helps traders make informed decisions. Additionally, Exness emphasizes transparency with real-time financial statistics and offers multilingual customer support. The platform also stands out for its instant withdrawal system, which is especially appealing to active traders.

In essence, Exness is designed for those looking for a user-friendly platform with a wide range of assets, tools, and flexible trading conditions. And this Exness broker review is proof of that.

| Regulatory Body | Status |

| ASIC | No |

| CySEC | Yes |

| DFSA | No |

| EFSA | No |

| FCA | Yes |

| FMA | No |

| FSA (SC) | Yes |

| FSCA | Yes |

| FSC | Yes |

| JFSA | No |

| MAS | No |

| MiFID | Yes |

Expert Reviewer’s Conclusion

This review will examine in detail all aspects of working with the trading broker Exness. Experts note that this broker provides a wide range of opportunities for traders, from an intuitive platform to favorable trading conditions. Experts positively evaluate the functionality of Exness, emphasizing the convenience of work for both beginners and professionals. The review will examine key points, including the quality of service, the speed of execution of transactions and available tools for analysis, so that you can make an informed decision when choosing a broker.

Advantages and disadvantages

Advantages

- Five types of accounts;

- Deposit from $10;

- Stable and low spreads;

- More than 70 MetaTrader servers worldwide;

- Ability to customize leverage;

- No overnight fees for most assets.

Flaws

- Limited access to educational materials for newbies.

- No welcome bonus.

Security and Warranty Features

Regulated and Secure

Exness is regulated by multiple top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK, CySEC (Cyprus Securities and Exchange Commission), and Seychelles FSA (Financial Services Authority). These regulatory bodies enforce strict standards to ensure transparency, financial stability, and protection of client funds.

Segregation of Client Funds

Exness ensures that client funds are kept separate from the company’s operational accounts. This means that even in the unlikely event of company insolvency, client funds remain secure and cannot be used to cover the broker’s liabilities. Segregated accounts are held in reputable, top-tier banks, providing an extra layer of protection.

Negative Balance Protection

For retail clients, Exness offers negative balance protection. This ensures that traders cannot lose more money than they have deposited in their account. In the volatile world of forex and CFD trading, this is a critical feature that protects clients from falling into debt due to market fluctuations. Therefore, this Exness forex review is proof of that.

Investor Compensation Fund (ICF)

Clients under Exness Cyprus (CySEC-regulated) are covered by the Investor Compensation Fund (ICF). This fund is designed to protect clients in case the broker fails to meet its obligations. Eligible clients may be compensated up to a certain amount, offering an extra safety net.

Regular Audits and Transparency

Exness maintains a high level of transparency by conducting regular audits of its financial operations. These audits are performed by BDO, a leading international auditing firm. The broker also publishes its financial reports and trading volumes on its website, allowing clients to verify the broker’s financial health and operational integrity.

Security for Payment Methods

Exness supports multiple secure payment options for deposits and withdrawals, including bank transfers, credit cards, and e-wallets. Each payment method is subjected to thorough security protocols, and client withdrawals are processed promptly, minimizing any potential risks of financial theft or fraud.

Tradable Instruments

Abundant Trading Choices

Exness is renowned in the trading world for offering an extensive range of trading opportunities that cater to both novice and experienced traders alike. What sets Exness review 2024 apart is the sheer diversity and depth of its trading pairs, allowing traders to explore global financial markets with unmatched flexibility. Whether you’re interested in forex, commodities, cryptocurrencies, or indices, Exness ensures that you have access to some of the most sought-after instruments in the industry.

In the forex market, Exness provides an impressive selection of major, minor, and exotic currency pairs. This variety allows traders to leverage different strategies, whether it’s hedging, speculating on price movements, or taking advantage of high volatility. The availability of less conventional currency pairs gives traders the opportunity to explore unique market conditions and capitalize on emerging trends.

Beyond forex, Exness offers a solid array of trading options in other asset classes. Traders can delve into the growing world of cryptocurrencies, where volatility opens the door to potentially high returns. The platform’s offerings extend to precious metals, energy commodities, and global indices, giving traders the freedom to diversify their portfolios and balance risk across different markets.

Account Types

Diverse and Inclusive

One of the entry-level options is the Standard Cent account, which is ideal for new traders or those looking to test their strategies in a low-risk environment. It allows for smaller transactions using cents as the base currency, providing a great opportunity for beginners to learn how to trade in real market conditions without significant financial exposure. This account offers low spreads, no commissions, and flexible leverage, making it a great starting point for those who want to practice without feeling overwhelmed.

For those who have some trading experience and are looking for a more conventional trading account, the Standard account is an excellent choice. It offers no commission and competitive spreads, making it suitable for a wide range of traders. The Standard account provides access to all the major currency pairs and other instruments, allowing for greater flexibility and trading volume. This account type is popular due to its user-friendly nature, offering both affordability and solid trading conditions.

For more experienced traders who require even tighter spreads and faster execution, Exness offers the Pro account. This account type is geared toward those who demand more precision and speed in their trades, with significantly lower spreads starting from 0.1 pips. The Pro account is also commission-free, but it provides access to more sophisticated trading tools and features, catering to traders who are looking for an edge in the market.

For professionals who need the best possible trading conditions, Exness has the Zero account, which offers zero spreads on most of the major currency pairs. This account is especially beneficial for those using high-frequency or scalping strategies, as it allows traders to minimize trading costs. A commission is charged on this account, but the advantage of zero spreads more than compensates for it, especially for those who prioritize cost efficiency.

The Raw Spread account combines the best of both worlds by offering extremely tight spreads, starting from 0 pips, alongside a small commission per trade. This account is popular among traders who prefer transparency in their trading costs and wish to have direct access to raw market spreads. The low spreads and modest commission make it an attractive option for traders who want high liquidity and tighter control over their costs.

Broker commissions

Flexible and Transparent

Exness is known for its transparency in pricing and commissions. All fees are outlined clearly, giving traders the ability to calculate their trading costs upfront. Whether you are trading forex or CFDs, Exness ensures that there are no hidden fees, allowing for more accurate profit and loss estimations.

Account Minimum

Exness offers various account types, and the minimum deposit can vary depending on the account chosen. Some accounts, like the Standard account, have no minimum deposit requirements, while others, such as the Raw Spread and Zero accounts, may require a minimum deposit of $500 or more.

Trading Fees

Exness provides a competitive fee structure across its account types. For instance, the Standard account has no commission on trades, with fees built into the spread. On the other hand, the Raw Spread and Zero accounts offer very low spreads but charge a commission per trade. This flexibility allows traders to choose the account that best suits their strategy and cost expectations.

CFD Fees

For those trading Contracts for Difference (CFDs) on indices, commodities, or cryptocurrencies, Exness charges fees through the spread. CFD spreads are competitive, ensuring that even high-volume traders can minimize their trading costs. CFD traders should also consider overnight funding fees (swap fees), which may apply if positions are held overnight.

Forex Fees

Exness offers tight spreads for forex trading, with some accounts featuring spreads starting as low as 0.0 pips. Forex fees can vary based on the account type, with commission-free trading on the Standard account and commissions ranging from $3.50 per lot on other accounts.

| Bundle | Live spread AM | Live spread PM | Industry Average |

| EUR/USD | 1 Pip | 1 Pip | 1.08 Pips |

| GBP/JPY | 2.5 Pips | 2.5 Pips | 2.44 Pips |

| Gold | 20 Cents | 20 Cents | 42 Cents |

| WTI Oil | 2.8 Cents | 2.8 Cents | 20 Cents |

| Dow 30 | 7.5 Pips | 7.7 Pips | 3.3 Pips |

| Dax 40 | 5.7 Pips | 5.8 Pips | 2.4 Pips |

| Apple | n/a | 9 Cents | 33 Cents |

| Tesla | n/a | 10 Cents | 50 Cents |

| Bitcoin | $78.15 | $71.92 | $35.50 |

Account Fee

Exness does not charge any account maintenance fees, ensuring that traders do not incur additional costs simply for having an account.

Inactivity Fee

There are no inactivity fees with Exness. Traders can rest assured that if they take a break from trading, they will not be penalized for leaving their account dormant.

Deposit Fee

Exness stands out by offering zero deposit fees. Whether you deposit via credit card, bank transfer, or e-wallet, you won’t face any charges. This feature is especially appealing to traders who frequently fund their accounts in smaller amounts.

Withdrawal Fee

Similar to deposits, Exness does not charge any withdrawal fees. This policy makes Exness highly attractive for traders who make regular withdrawals from their accounts. However, depending on the withdrawal method, there may be fees charged by the payment provider or intermediary bank.

Overnight Funding Fee

Traders who hold positions overnight may incur overnight funding fees, also known as swap fees. These fees are dependent on the instrument traded and the size of the position. Exness provides clear information about swap rates for each asset on their platform, helping traders understand potential costs.

Currency Conversion Fee

If you trade in a currency different from your account’s base currency, Exness may apply a currency conversion fee. This fee is typically a small percentage of the transaction amount and can vary based on the currency pair involved.

Guaranteed Stop Order Fee

Exness does not currently offer guaranteed stop orders, which are common with certain brokers to limit losses. As such, there are no guaranteed stop order fees to worry about. However, traders should use regular stop orders carefully to manage risk effectively.

Trading Platforms

Diverse Tools for Varied Traders’ Needs

Exness provides an impressive variety of trading tools catering to all types of traders. From risk management tools like stop-loss and take-profit, to advanced order types and margin calculators, Exness ensures that both novice and experienced traders have access to everything they need to succeed.

Mobile Trading Apps

For traders who are always on the go, Exness offers intuitive mobile trading apps. Available on both iOS and Android devices, these apps allow users to trade, analyze charts, and monitor the markets in real-time. The mobile apps are optimized for small screens while still offering a full range of features, such as instant trade execution, push notifications for price alerts, and advanced charting tools.

| Trading Platform | Available |

| MT4 | Yes |

| MT5 | Yes |

| CTRADER | No |

| PROPRIETARY | No |

Web Trading Apps

Exness’ web-based trading platforms allow traders to access the markets from any browser without the need for downloads or installations. The web apps are user-friendly and provide a complete trading experience, from order execution to chart analysis. With fast, reliable connections and a wide array of technical indicators, web trading on Exness offers the flexibility to trade from anywhere with an internet connection.

Desktop Trading Apps

For those who need more robust trading tools, Exness also offers desktop applications. These platforms are designed for high-performance trading, providing advanced features like algorithmic trading, multi-window support, and highly customizable layouts.

Charting, Ease of Use, and Additional Features

One of the standout features across all Exness platforms is the advanced charting capabilities. Traders can access a variety of chart types, including line, bar, and candlestick charts, to track price movements.

Exness platforms also come with additional features that enhance the trading experience. Traders can access educational resources, including market analysis, trading signals, and webinars directly through the platforms. There are also options for social trading, where users can follow and copy the trades of more experienced investors. Moreover, the platforms support multi-lingual customer service and offer various deposit and withdrawal methods, making account management simple and convenient.

Unique Features

Empowering Traders

Data Analytics. Exness has integrated robust data analytics tools that empower traders to make informed decisions. The platform provides detailed charts, historical data, and advanced analytical tools to help users understand market trends and patterns. With features such as technical indicators, oscillators, and customizable chart settings, traders can perform in-depth analysis to identify potential trading opportunities.

Data Comparison. The data comparison feature on Exness enables users to juxtapose various market data points efficiently. Traders can compare different financial instruments, such as currencies, commodities, and indices, to evaluate their performance side by side. This feature simplifies the process of assessing relative strength and volatility, helping traders make more strategic decisions.

Push Notifications. To keep traders informed and engaged, Exness employs real-time push notifications. These alerts can be customized to notify users about significant market movements, price changes, or technical signal triggers. Push notifications ensure that traders never miss crucial information that could impact their trading strategies.

Research and Education

Enhancing Trader Education

Exness offers comprehensive training for its traders through:

- Educational Resources. Access to a range of materials including webinars, e-books, and video tutorials tailored for different trading levels.

- Trading Academy. Structured courses covering fundamental and advanced trading strategies, market analysis, and risk management.

- Personalized Coaching. One-on-one sessions with experienced traders for tailored guidance and support.

- Demo Accounts. Practice trading with virtual funds to build skills without financial risk.

- Market Analysis Tools. In-depth tools and insights to help traders make informed decisions.

- Community Support. Forums and social media groups for peer-to-peer learning and exchange of trading experiences.

Customer Support

Multi-Channel Assistance

The trader support service on the Exness trading platform consistently demonstrates excellence in providing timely and effective assistance. Their team of professionals is well-versed in addressing a range of inquiries, from technical issues to account management queries. Support is available around the clock through various channels, including live chat, email, and phone, ensuring that traders can receive help whenever needed. The service is noted for its quick response times and comprehensive solutions, contributing to a seamless trading experience.

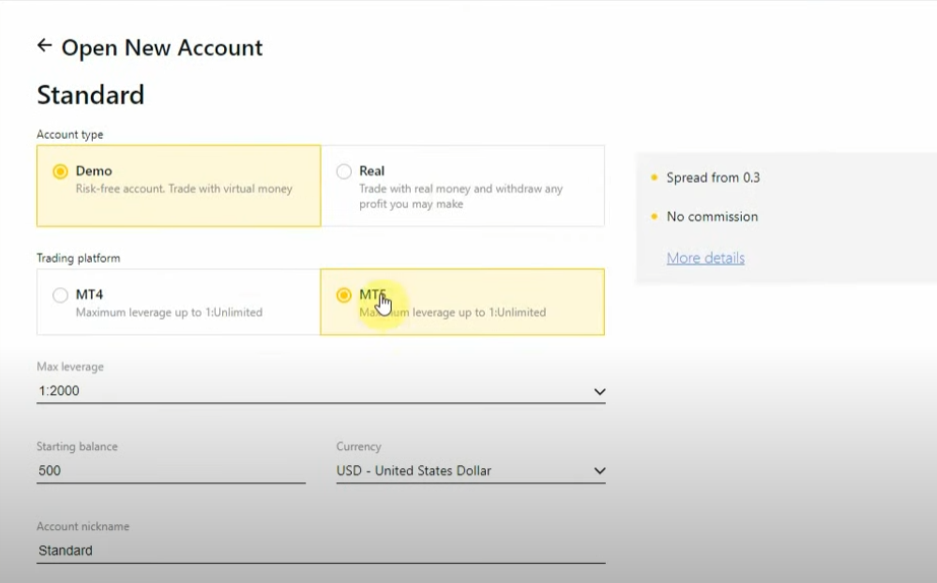

Account Opening

Easy and Quick

To create an account and open an account on the Exness trading platform, follow these steps:

- Visit the Exness Website. Go to the official Exness website using your web browser.

- Sign Up for an Account. On the homepage, locate and click the “Open Account” button. You’ll be prompted to enter your email address, create a password, and select your country of residence. Ensure your password meets Exness security criteria, such as having a mix of letters, numbers, and symbols.

- Verify Your Email. After entering your details, you’ll receive a confirmation email.

- Complete Your Profile. Once your email is verified, log into your account and complete the profile setup.

- Choose Your Trading Account Type.

- Deposit Funds. Navigate to the Deposit Section: In your dashboard, click on the “Deposit” tab.

- Download the Trading Platform. Exness offers several platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Creating an account on Exness is straightforward and designed to be beginner-friendly. After completing these steps, you’ll have access to a range of financial markets, user-friendly trading platforms, and secure payment methods to help you succeed as a trader.

Deposit and Withdrawals

Minimizing Transaction Fees

The Exness platform is designed in such a way that users will not have any difficulties with replenishing their account and receiving their funds.

Replenishment of the account. The deposit process is carried out automatically without a commission for depositing funds. You can use: bank cards, electronic wallets and other methods.

Withdrawal of funds. You can create a withdrawal request for identical details. Withdrawal is carried out in a semi-automatic mode and can take a couple of days.

Final Thoughts

Exness stands out as a premier broker due to its unwavering dedication to transparency, security, and intuitive features. Its robust regulatory framework, extensive selection of trading instruments, and focus on user experience establish it as an exceptional ally for traders looking for a dependable and forward-thinking trading partner.

Contact Info

- Website: www.exness.com

- Email: [email protected]

- Company Address: 1, Siafi Street, Porto Bello, Office 401, Limassol, Cyprus

FAQ

What account types are available on Exness for different traders?

Exness offers a range of account types, including Standard, Raw Spread, Zero, and Pro accounts, catering to both beginners and experienced traders. Each account has unique features like different spreads and commission structures.